Cumulative compound interest calculator

PPMTratepernperpv Where pv Present value of loan. In finance interest rate is defined as the amount that is charged by a lender to a borrower for the use of assetsThus we can say that for the borrower the interest rate is the cost of debt and for the lender it is the rate of return.

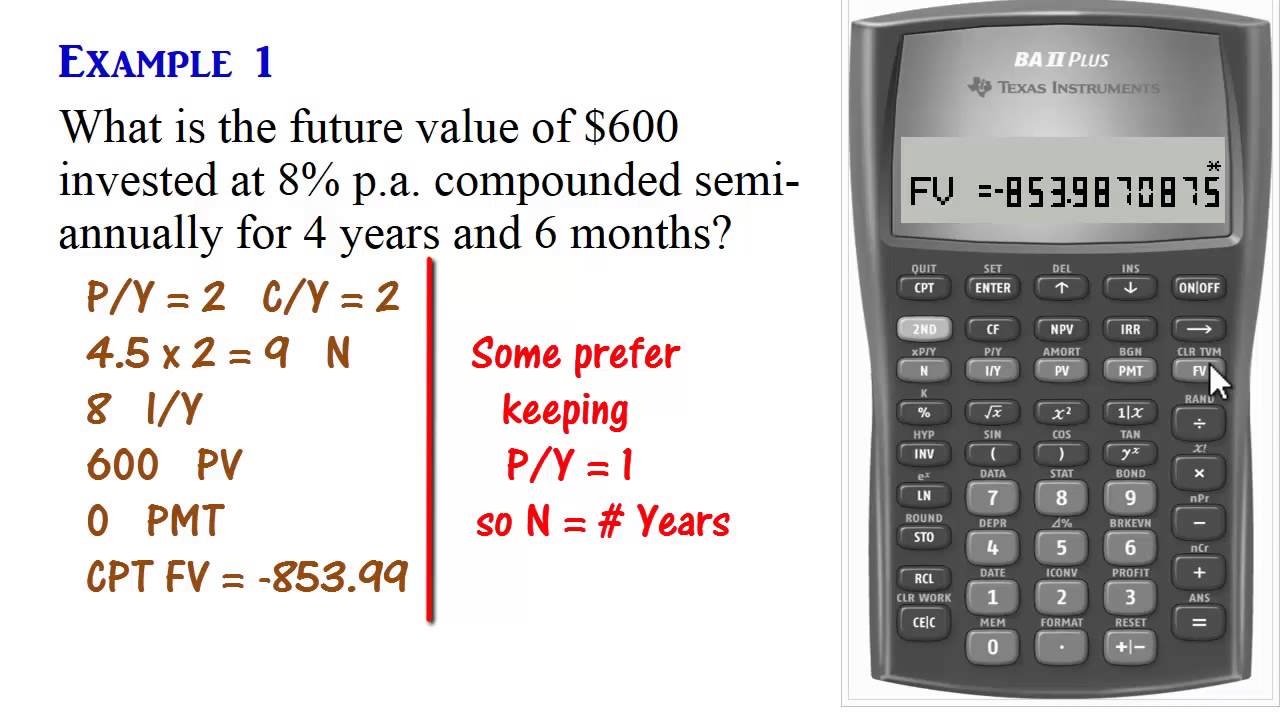

Ba Ii Plus Calculator Compound Interest Present Future Values Youtube

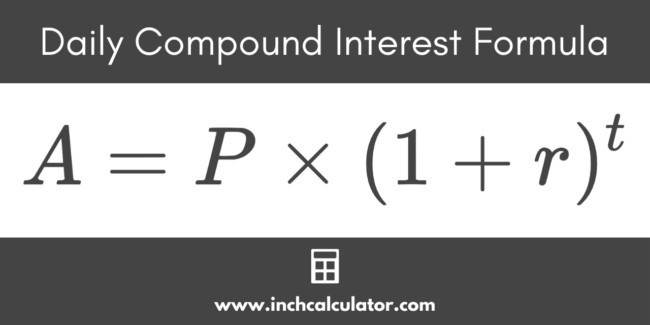

FV PV 1 i n where.

. Though a 5-year tax-saver FD account is chosen by individuals to save tax in a safer way the returns from the account are taxable under the Income Tax Act. In this example its 31833 35166 3333. A mortgage calculator helps prospective home loan borrowers figure out what their monthly mortgage payment will be.

However in case you wish to calculate compounding on other basis say monthly half yearly or annual basis then use our other calculator then click on the link. Cumulative Distribution Function Applications. View Another Fixed Deposit Calculator - With Compounding of Interest on Monthly Quarterly Half Yearly or.

Principal total interest cost months to payoff and more. 5500 after two years we need to calculate a present value of Rs. 5500 is higher than Rs.

The investment can be liquidated before maturity only at the cost of a penalty on the interest rate promised which is nothing but a loss. Lets say you invest 500 at an 8 annual return. P1 RNNT A.

5000 if the present value of Rs. Using the compound interest formula. By default the calculator assumes your grant vests equally over four years with a one-year cliff and quarterly vests.

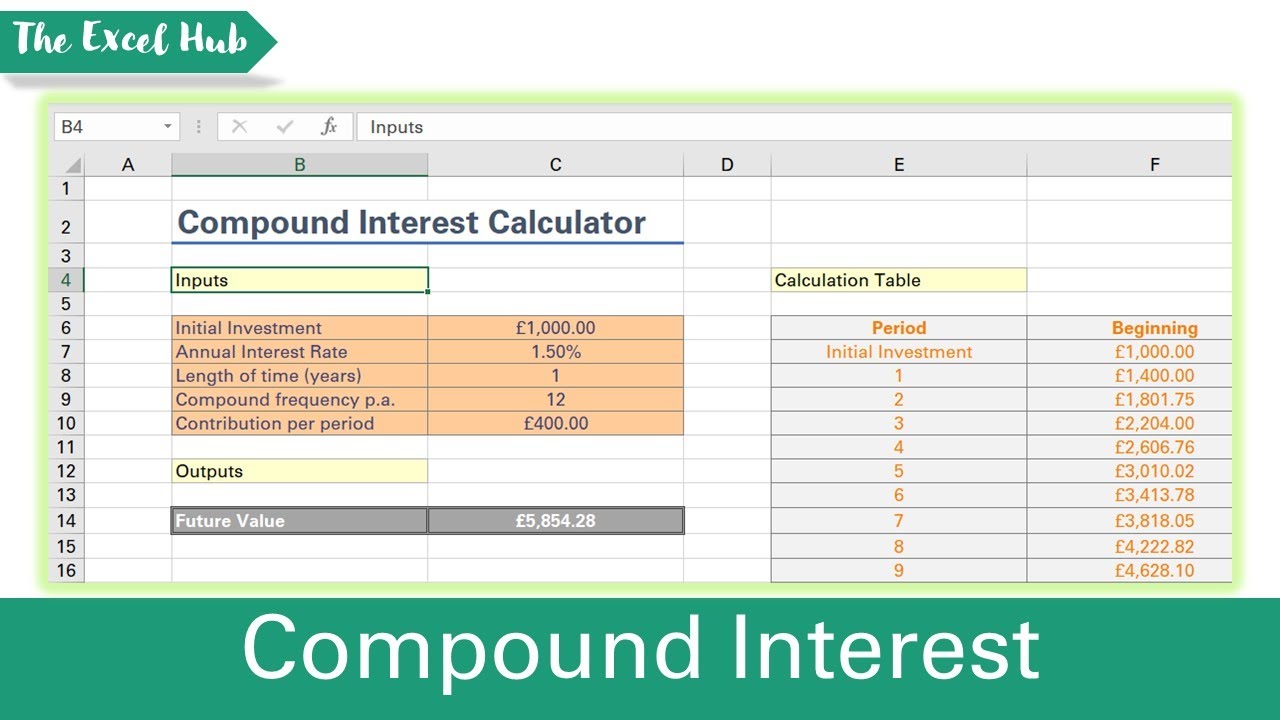

5500 on the current interest rate and then compare it with Rs. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. I have created a cumulative interest calculator Template to calculate all of the above calculations for interest in a single worksheet.

Finding the frequency of occurrence of values for the given phenomena using cumulative frequency analysis. Thought to have. If you are choosing non-cumulative you can earn interest on a monthly quarterly half-yearly or on yearly basis.

Over five years this is how much cumulative interest you will earn if the interest is compounded monthly. Note here that in case you make a deposit in a bank eg put money in your saving account from a financial perspective it means that you. Interest paid in year 1 would be 60 1000 multiplied by 6 60.

With these you can repeatedly borrow on the same card and you get to choose how much youll repay each month as long as you meet the minimum paymentThese types of loans are also known as revolving debtInterest-only loans. Find your monthly interest rate. CUMIPRINCratenperpvn1n20 To calculate principle paid in an EMI below formula is used.

5000 then it is better for Company Z to take money after two years otherwise take Rs. The cliff is the first date you receive any share of the new grant. 5000 today or Rs.

Divide your interest rate by 12 to get your monthly interest rateIn this case its 0008333 01012. A mortgage payment calculator takes into account factors including home price down payment loan term and loan interest rate in order to determine how much youll pay each month in total on your home loan. Pmt Payment per period.

For cumulative deposits the interest earned will get compounded on a monthly basis along with the principal amount. Most people just see the aggregate finance charge on their bill and have no idea that it represents a cumulative tally of each days interest charges for the entire month. Subtract your interest payment from your total monthly payment to see how much goes toward paying down your loan.

Calculate your principal payment. Whether Company Z should take Rs. Lets go over the compound interest formula and define each of the variables.

Compound interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. P is the investment or principal balance at the start of. After 10 years of continuous compound interest at 5 the tally would equal 8235.

Preferred stock combines aspects of both common stock and bonds in one. CUMIPMTratenperpvn1n20 To calculate cumulative principle payment for period n1 through n2. The compound annual growth rate CAGR is the mean annual growth rate of an investment over a specified period of time longer than one year.

Interest rate inflation n. Shriram City offers both cumulative and non-cumulative term deposits. Now in order to understand which of either deal is better ie.

These loans dont amortize either at least not at the beginningDuring the interest-only period youll only pay down the. A compound interest calculator will help you determine how fast youll save money or spend money depending on your financial situation investments and debts. Preferred stock is a special type of stock that pays a set schedule of dividends and does not come with voting rights.

Given that money changes with time as a result of an inflation rate that acts as compound interest we can use the following formula. Number of times the interest is compounded ie. In statistical analysis the concept of CDF is used in two ways.

Calculate interest compounding annually for year one. Treasury savings bonds pay out interest each year based on their interest rate and current value. This credit card interest calculator figures how much of your monthly payment goes to interest vs.

Compound Annual Growth Rate - CAGR. The most important application of cumulative distribution function is used in statistical analysis. Cliffs are typical for a new hire grant although ongoing grants also known as top-ups or refreshers sometimes vest immediately.

Calculate your interest payment. To calculate cumulative interest payment for period n1 through n2. In India banks use quarterly compound interest calculator in rupees.

Assume that you own a 1000 6 savings bond issued by the US Treasury. Try the cumulative interest calculator above to check your interest earned figure with a lump sum a continuous contribution or both. Thats an increase of 735 on the rate offered by simple interest.

Compound Interest Calculator Daily Monthly Quarterly Annual

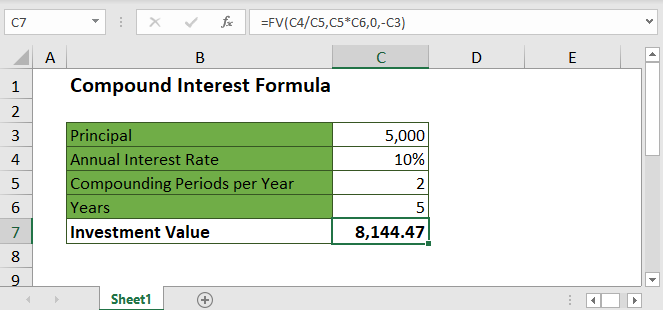

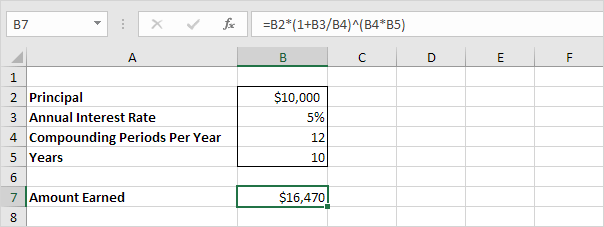

How Can I Calculate Compounding Interest On A Loan In Excel

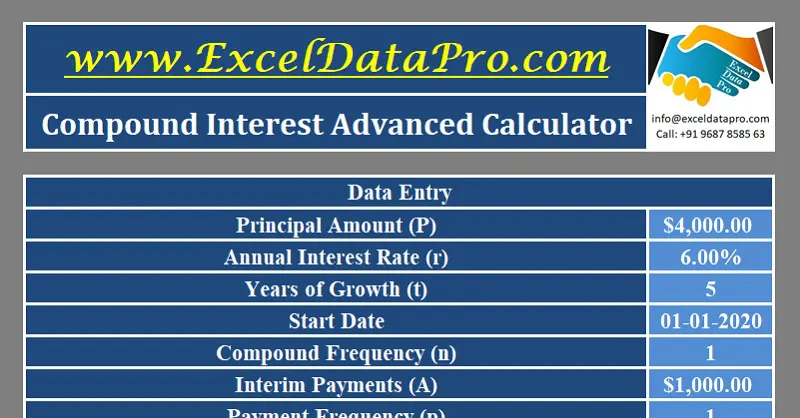

Download Compound Interest Calculator Excel Template Exceldatapro

Compound Interest Formula And Calculator

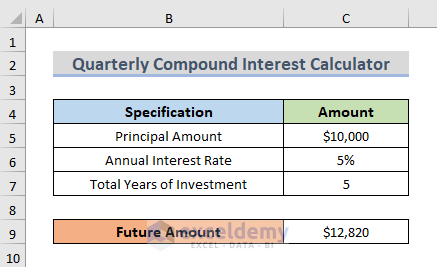

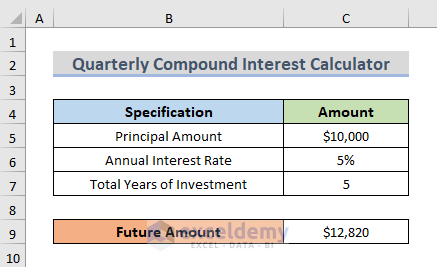

How To Create Quarterly Compound Interest Calculator In Excel

Compound Interest Formula And Calculator For Excel

Daily Compound Interest Calculator Inch Calculator

Compound Interest Calculator In Excel Calculate Savings Using Fv Function Youtube

Online Interest Calculator Wolfram Alpha

Compound Interest Formula And Calculator

Compound Interest Formula In Excel And Google Sheets Automate Excel

Compound Interest Calculator Financeplusinsurance

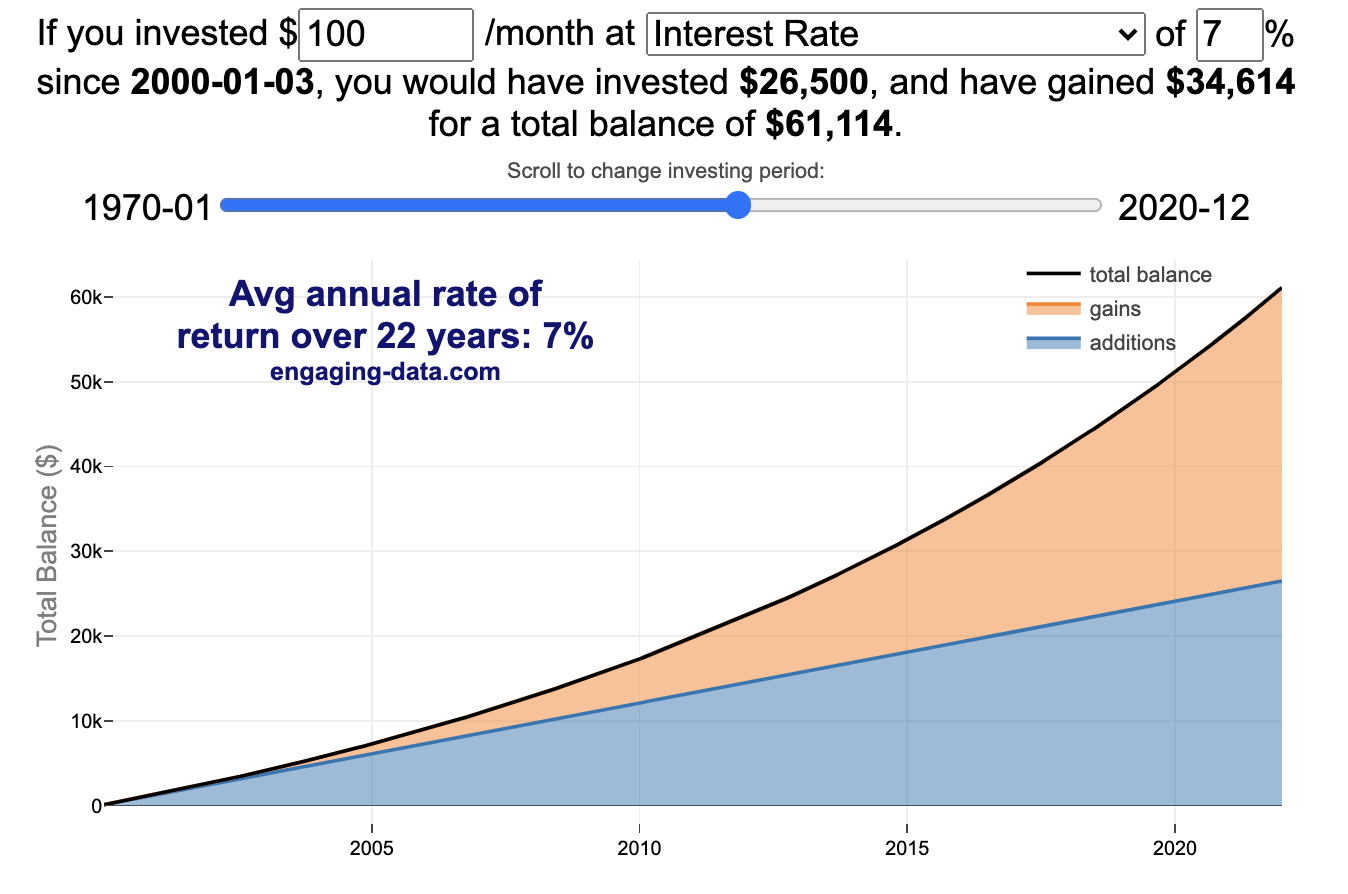

Compound Interest And Stock Returns Calculator Engaging Data

Compound Interest Calculator For Excel

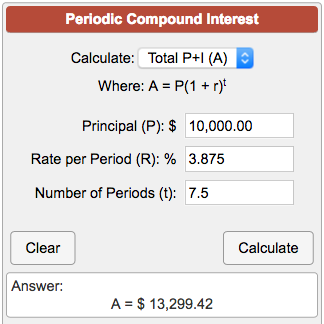

Periodic Compound Interest Calculator

How Do I Calculate Compound Interest Using Excel

Compound Interest Formula In Excel In Easy Steps